Although poverty in Central and Eastern Europe fell by 6% from 2018 to 2019, 14 million people, or 27% of the population, are still at risk of poverty in Austria, Croatia, the Czech Republic, Hungary, Romania, Serbia and Slovakia. Many of them are unable to meet unforeseen expenses or lack basic amenities such as heating or sanitary facilities. In the Czech Republic, for instance, 42% of households struggle to meet housing costs, while in Serbia 65% of all inhabitants live in overcrowded homes. The most common reasons are unemployment and limited access to financial resources. Many NGOs and social enterprises devoted to these problems also have little access to financing as their business models are by definition not profit-oriented, which makes them unattractive to most banks. They receive little support from the state, and access to EU subsidies is difficult.

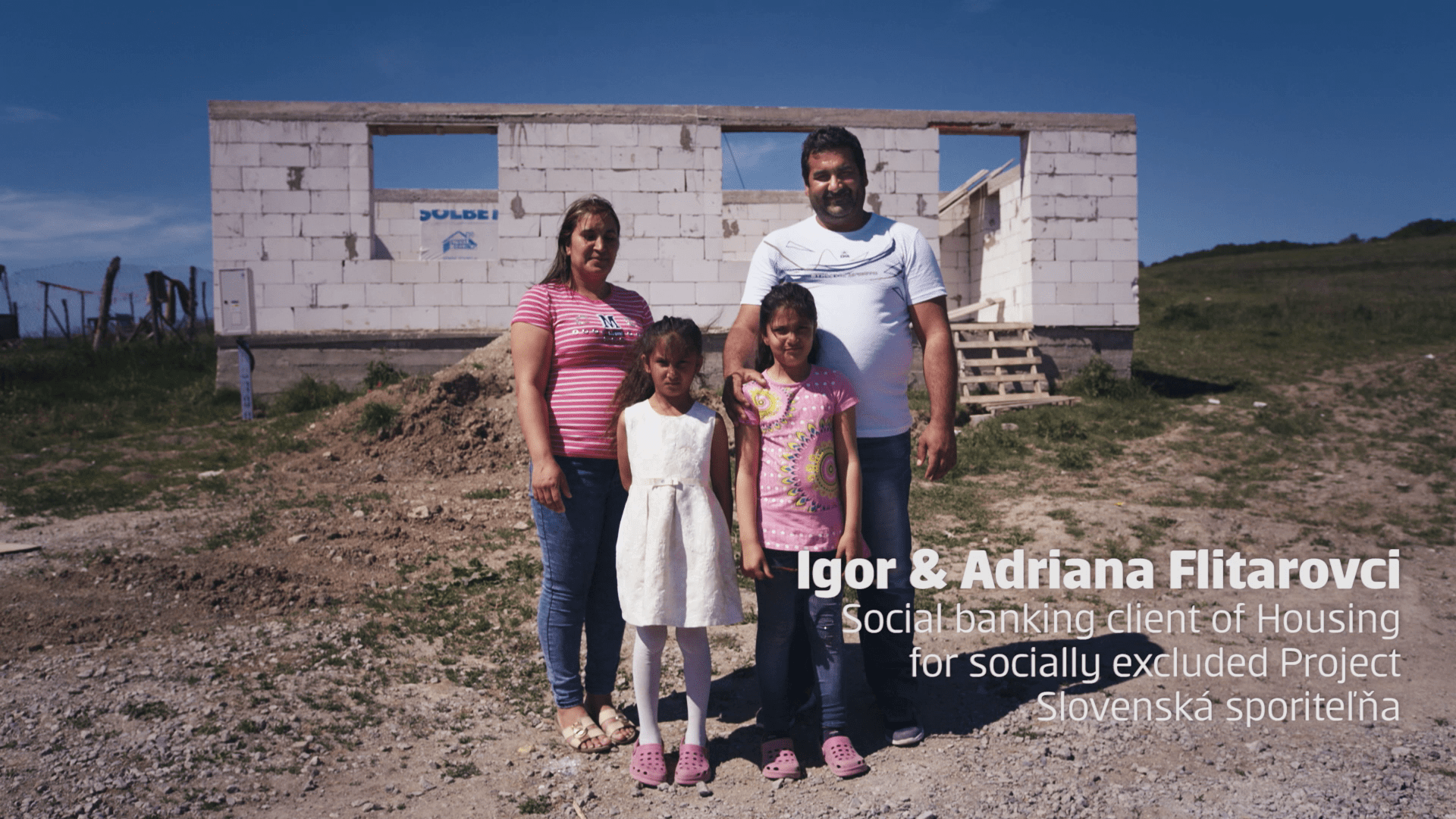

“I’m happy that we are building a house to live better, to have everything we need to live like water, electricity. I want the best for the children, to provide a roof over their heads for when I’m gone.”

Igor Flítár builds a house in Rankovce, Slovakia, with a micro-loan.

Erste Group operates in the above mentioned countries. As Erste Group’s main shareholder, ERSTE Foundation supports the bank’s efforts to improve the financial stability of customers not usually eligible for bank support. Erste’s Social Banking programme cooperates closely with local partners to support start-ups, small businesses, social organisations and low-income people. Its services range from financing to mentoring and training. More than 1000 social organisations, 22,400 people in financial difficulties, 9,600 small farmers and 6,400 entrepreneurs launching small businesses in areas with high unemployment and poverty have already benefitted from the programme. To date, Erste Social Banking has awarded a total of EUR 485 million in loans.

This approach has yielded sustainable and measurable success, helping to create more than 26,000 new jobs and preserve more than 50,000 existing ones in the region. Successful businesses include a generation café in Vienna, a sheep farm in Romania and a shop selling organic baby clothing in Croatia. The most jobs have been created in agriculture, livestock breeding, transport and communication, retail, education and health, thanks to measures including working capital loans, bridging loans, start-up loans, business training, e-learning, mentoring and business plan evaluations. These measures decisively contribute to the success of borrowers, which reduces the risk for the bank and allows it to help a larger number of people.

Maria Hăşmăşan and her family live in the small Romanian village of Leurda. With the support of a micro-loan provided by BCR Social Finance they produce lamb, milk and cheese.

Erste Foundation and Erste Group started out as social enterprises themselves, over 200 years ago. Today, we work together to create a sustainable basis that enables individuals, young social enterprises and NGOs to improve their economic situation and achieve long-term financial stability. The development of civil society will come up against limits if the NGOs and social entrepreneurs devoted to some of our society’s most challenging issues do not have sufficient financial resources. Access to basic financial products for low-income people is widely recognised as a critical step in fighting poverty sustainably. People with basic financial literacy are better able to respond to unexpected financial shocks and cope with future risks. As well as providing financial stability for their families, small entrepreneurs often also create new jobs and promote economic growth in their communities. For a third of entrepreneurial clients, a start-up loan means a path from unemployment to their own business. On average, each new business start-up creates two additional jobs. 50% of entrepreneurs participating in

the Erste Social Banking programme report that starting or expanding their business would not have been possible without support from Erste. By combining financing with financial education, our aim is to secure long-term financial prosperity.

Social Housing: DOM.ov

The DOM.ov programme was created to enable Roma families in particularly under-supplied areas of eastern Slovakia to build their own houses. Social work and financial inclusion lead to a simple but energy-efficient home. The Social Banking programme offered by Slovenská sporiteľňa and an NGO help families to find work, support construction and impart financial skills. For a period of twelve months, the families have to regularly put money aside before they can buy a plot of land from the local community. The bank provides a micro-loan for the building materials, which is guaranteed by ERSTE Foundation. The families build the houses themselves, under the supervision of an NGO. Financial and active self-participation of the Roma families increases the success rate and efficiency of public funds. DOM.ov uniquely combines the experience and expertise of fieldwork NGOs, municipalities, foundations, architects and a bank.

MORE PROJECTS: